Customers can apply for home financing by the simply clicking the newest connect lower than, completing the relevant pointers, examining its qualification, and having financing offer:

- State Financial Out-of Asia also provides lowest-appeal home loans that are processed free of charge.

- There are no prepayment punishment on these SBI mortgage loans.

- SBI even offers mortgage brokers that have words anywhere between three so you’re able to 30 age.

The state Lender away from Asia (SBI) possess introduced the https://availableloan.net/installment-loans-hi/ country’s first credit score-connected home loans, that have costs only six.70 percent regardless of loan amount. The fresh new SBI has introduced this loan into the expectation of one’s country’s impending christmas. Before, a mortgage of greater than Rs 75 lakh sent an enthusiastic rate of interest from eight.15 per cent. To have a good Rs 75 lakh loan that have a thirty-season name, the deal causes an excellent forty five basis section offers, which represents a giant focus rescuing of greater than Rs 8 lakh.

Regular Home loan, SBI Advantage Mortgage having regulators team, SBI Shaurya Mortgage to possess military and you may defence personnel, SBI MaxGain Mortgage, SBI Smart Family, Top-up Mortgage getting existing consumers, SBI NRI Financial, SBI FlexiPay Financial to possess loan off high number, and SBI HerGhar Financial for women are among the home loans supplied by the financial institution.

County Lender Out of India now offers reduced-attract mortgage brokers which might be processed free of charge. There are no undetectable or administrative charge associated with the financing operating. While doing so, if a female takes out a mortgage, she’ll be eligible for price decrease for ladies borrowers and you can credit history-linked mortgage brokers. There aren’t any prepayment charges on these SBI house loans. These mortgage brokers may also be used given that an overdraft. The SBI has the benefit of home loans that have terms ranging from about three so you’re able to 3 decades. 70 %, no matter what mortgage size.

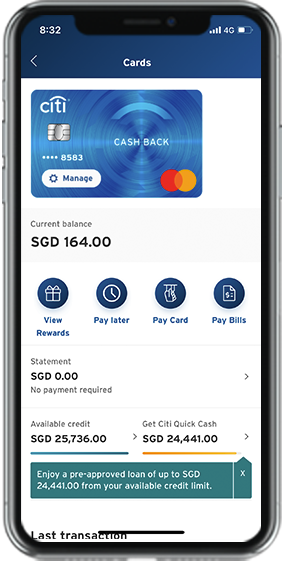

Yono SBI app are often used to make an application for a home financing. To start, visit your YONO SBI app and you will log on. Click on the diet plan above high kept of main web page, after that loans, upcoming Mortgage. Following, create a fast qualifications have a look at from the typing your big date out of delivery, income source, online month-to-month income, details of any earlier finance, or any other expected information, ahead of clicking complete. You will be given a guide matter, and you may a keen SBI professional usually get in touch with your immediately.

For a mortgage, needed an employer ID card, along with a credit card applicatoin. 3 passport-proportions pictures connected so you can a totally done loan application means. Whatever identity, such as for example a cooking pan, passport, driver’s permit, otherwise voter ID card. Proof house and you can target, and a recent duplicate out-of a phone statement, electronic costs, water bill, or piped gasoline costs, or a copy out-of a passport, riding licence, or Aadhar credit. Framework permission (where relevant). Fee Receipts or bank An effective/C comments appearing all the costs built to Builder/Provider, including bank account comments over the past 6 months for everybody bank account owned by brand new candidate/s.

Which credit-connected home loan features a low interest of around 6

To have salaried people, money confirmation is essential in order to see a mortgage. The final about three months’ income slip otherwise paycheck certification need to be presented due to the fact proof. As well as, the form sixteen into prior 24 months otherwise a copy of It Output into past a couple financial ages, given that acquiesced by brand new They Agency. Non-salaried candidates must provide confirmation regarding providers address therefore output into early in the day three years. On top of that, a balance layer and you can profit and loss account fully for the prior 3 years, also an excellent TDS Certification (Form 16A, in the event the relevant), are needed.

Sit told with the all the latest development, real-time-breaking news reputation, and you may pursue every crucial statements from inside the asia news and you may business Development towards Zee News.